These are tough times for buddies of Big Oil on Capitol Hill. How do you stand by your men amid photos of thick pools of oil lapping into the marshes of southern Louisiana and more video of BP pipes gushing oil?

But love, as always, finds a way.

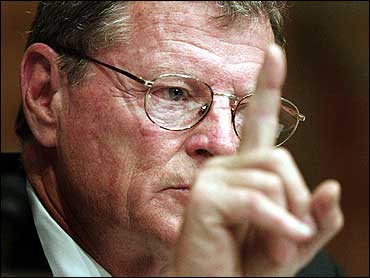

In the Senate, fossil-fuel fans James Inhofe (R-Okla.) and Lisa Murkowski (R-Alaska) have managed to grab hold of an issue that shows oil execs that they’ve still got their backs: liability.

Senate Democrats Robert Menendez and Frank Lautenberg of New Jersey and Bill Nelson of Florida are pushing a proposal to raise the liability cap on oil spills from its current paltry level of $75 million to a more realistic $10 billion. Last week, Murkowski blocked it. Yesterday, Inhofe did.

And he trotted out the same contorted logic Murkowski’s been using: If you set the cap too high, you risk putting smaller independent oil companies out of business. Then only BP, ExxonMobil, and other oil giants will be left, he argued. In short, he and Murkowski say they’re looking out for the little guys, all things being relative.

Then things really got strange. While testifying before the Senate’s Energy and Natural Resources Committee, Interior Secretary Ken Salazar started channeling Inhofe and Murkowski, saying that Congress should avoid setting an “arbitrary” cap, and that, yes, we don’t want to hurt smaller oil companies.

Sen. Mary Landrieu (D-La.), another Big Oil booster, commended Salazar for “taking your time” on setting a cap.

All that, of course, didn’t play very well with a lot of Democrats, starting with Senate Majority Leader Harry Reid (D-Nev.), who earlier in the day had said the cap should be eliminated altogether so companies responsible for spills would face unlimited liability. And then there was Nelson, who had already blasted away at a Republican idea that the cap should somehow be tied to a company’s profits. Here’s what he said:

For the life of me, I can’t understand someone objecting, as they are going to do, in raising an artificial limit of $75 million, up to at least $10 billion, and it’s probably going to exceed $10 billion. But the argument you’re going to hear is they are going to say, “Oh, it shouldn’t be this, it ought to be tied to profit.” Now, is it really responsible public policy to say that because of a company makes less money that it should be responsible for less damage? No.

By late in the day, the White House was trying to run damage control and back away from Salazar’s ambiguous comments. It issued a statement from Obama that condemned Republicans for playing “special interest politics” and blocking efforts to raise the liability cap.

The world, or at least the Capitol Hill slice of it, was back in balance.

See more play-by-play from yesterday’s hearings in The New York Times‘ Green blog.

Why didn’t we think of that?

Rep. Sam Graves (R-Mo.) has his own special take on the oil spill. It never would have happened, he says, if we had only gone ahead and drilled, baby, drilled in the Arctic National Wildlife Refuge in Alaska.

Timing is everything

This week, the BP Sea Otter Habitat exhibit opens at the Aquarium of the Pacific in Long Beach, Calif. Although the oil company donated $1 million for the facility, no BP officials are expected to attend. The Los Angeles Times has the story.