When it comes to certain things — luxury cars, beer, chocolate — we should just acknowledge that the Germans did it better than us first. This teutonic skill extends to solar power, where a tariff system ensures Germans pay less for solar energy than we do. But that doesn’t mean we can’t copy them, and if we do, comparatively sunny places like California stand to gain even more than cloudy Deutschland.

Newly installed solar photovoltaic (PV) projects in California were paid an average of approximately $0.34 per kilowatt-hour (kWh) last year, according to a privately commissioned study. Germans paid substantially less, taking into consideration the amount of solar energy their country receives.

Germans paid an average of $0.38/kWh for the first six months of 2011, according to data from the country’s grid manager, the Bundesnetzagentur.

If the Golden State applied German feed-in tariffs to solar PV under its bright, clear sky, Californians would only pay the equivalent of $0.24/kWh.

Data on the cost of German feed-in tariffs is from publicly available sources and is adjusted for California’s sunnier climate relative to cloudy Germany.

Unfortunately, data on the total cost of solar PV in California is more difficult to analyze, as it derives from numerous sources.

The study on California’s solar program, by private consultant Robert Freehling, examined the cost of the California Solar Initiative, federal tax credits, depreciation deductions, and the value of electricity offset from net-metering. Freehling is an expert in the arcane world of California renewable energy policy.

California Solar Initiative

The California Solar Initiative (CSI) is one of the state’s premier renewable energy programs, even though it only governs solar PV. CSI issues an up-front payment, or “rebate,” for residential solar systems and a payment per kWh for commercial systems, from a pool of money collected from ratepayers. The CSI funds are being rapidly depleted and in 2011, most of the funds for the program will be exhausted.

Because payments under the CSI, federal tax credits, and depreciation deductions necessary for investments in solar PV in the U.S. are all of short duration, it was necessary for Freehling to prorate these benefits over the typical 20-year life of a solar system. Only by prorating these benefits over 20 years and including the value of the electricity offset from net-metering was he able to estimate the total cost of electricity per kWh.

The average value of rebates under the CSI program in 2010 was $0.058/kWh. Residential customers were paid the least. They received $0.05/kWh while non-governmental and governmental organizations received as much as $0.09/kWh.

One unique feature of the CSI program, unlike many other such programs in the U.S., is that it makes special provisions for nonprofits and governmental agencies.

Nontaxable entities cannot use the 30 percent federal tax credits. Accordingly, the CSI issues a higher payment for nonprofits and governmental agencies to compensate for their inability to use the federal tax credits.

However, Freehling concluded that “in 2010 the benefit of this higher rebate was lost due to the higher price paid for solar projects by government and nonprofit entities.”

Federal subsidies

In addition to the CSI, a state program, residential and commercial solar projects in California qualify for federal tax credits and depreciation deductions. The costs of these subsidies are borne by all U.S. taxpayers, not just those living in California.

Last year, the value of the 30 percent federal tax credit was as high as $0.096/kWh for residential customers and $0.071/kWh for commercial customers, according to Freehling’s study. Nonprofits and other nontaxable entities received no benefit from the federal tax credit.

Freehling estimated that commercial projects received an additional benefit worth $0.07/kWh from accelerated depreciation.

Net-metering value

Net-metering is not a direct payment, nor is it a tax deduction. Net-metering is the ability to offset electricity consumption. Its value is that of the electricity offset.

The value of being able to “spin your meter backwards” varies widely across the state and by customer.

California is among the few states that use a “reverse block” rate structure that requires consumers to pay a higher price per kilowatt-hour the more electricity they consume. Many states and Canadian provinces use the archaic “declining block” rate structure that charges less per kilowatt-hour the more electricity a customer consumes.

Thus, in California, the value of net-metering is much higher for “energy hogs” who use the most electricity, and least to frugal consumers who conserve electricity. The value, reported Freehling, can vary from a low of $0.08/kWh for low-income consumers to as much as $0.38/kWh for those using the most electricity. The average value of net-metering across the state was substantial — $0.18/kWh — accounting for more than half of overall payments.

“Frugal customers that only pay 12 cents/kWh for all their electricity,” said Freehling, “will get little benefit from installing solar projects on their homes, while energy hogs that use three or more times the average amount of electricity will get the most benefit because the solar will be valued at nearly 30 to 40 cents/kWh.”

Average payments for solar PV in California in 2010 total $0.34/kWh for a system with a 20-year life, though total payments ranged from a low of $0.27/kWh for nonprofits and governmental entities to a high of nearly $0.38/kWh for commercial projects.

Germany’s feed-in tariffs

Freehling’s report did not specifically examine Germany’s feed-in tariffs for solar PV. However, data on the cost of the German program is much more readily available than data on solar PV installed in California.

There are no tax credits, rebates, grants, or other subsidies in the German program. There is no net-metering, though there is a small program that attempts to approximate a similar result that has not proven popular. There may also be depreciation deductions.

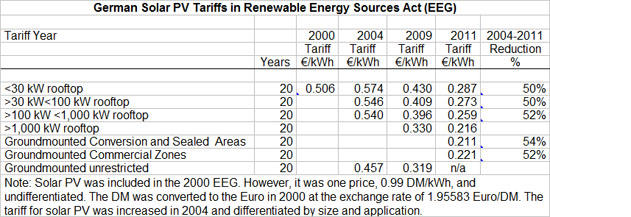

The posted tariffs vary from a high of $0.41/kWh for rooftop systems less than 30 kW to a low of $0.30/kWh for systems mounted on the ground at, for example, brownfield sites.

German tariffs are based on the cost of generation plus a reasonable profit. If German tariffs were applied directly to California without adjustment to the state’s greater solar intensity, the tariffs would pay more than necessary and result in windfall profits.

German tariffs in California

To compare Germany’s solar PV tariffs to those that would be appropriate in California, it is necessary to reduce the tariffs by an amount equivalent to the difference in the solar resource.

The solar resource in California is not uniform across the entire state. The rainy north coast, for example, has much less insolation than the blisteringly hot San Joaquin Valley. Any solar feed-in tariff program for California would have to take these differences into account.

Nevertheless, for the sake of a simple comparison, we can assume that a simple solar feed-in tariff for California would be about 64 percent of that currently paid in Germany.

Thus, German solar tariffs today applied to California would range from a low of $0.20/kWh for groundmounted systems on brownfield sites to nearly $0.27/kWh

for rooftop systems less than 30 kilowatts.

Average cost of German solar feed-in tariffs in 2011

According to data from the Bundesnetzagentur, Germany installed 717 megawatts (MW) of solar PV from January through April 2011. The average weighted payments per kilowatt-hour under the German program were $0.38/kWh. Under California conditions, these payments would be equivalent to $0.24/kWh.

Germans pay less than Californians

Germans pay less than Californians

A comparison between Freehling’s data on the total cost of solar PV in California and data from public sources in Germany shows that Californians are paying substantially more for solar PV than Germans, despite claims to the contrary.

Excluding the benefits of the depreciation deduction to California investors in solar PV, Germans are paying $0.03/kWh less for installations by nonprofits and government agencies than Californians, and nearly $0.07/kWh less for commercial projects.

Overall, Germany paid $0.07/kWh or 23 percent less for the 717 MW installed in the first part of 2011 than California paid for 200 MW of solar PV in 2010.

Overall, Germany paid $0.07/kWh or 23 percent less for the 717 MW installed in the first part of 2011 than California paid for 200 MW of solar PV in 2010.

Germans have cut solar rates 50 percent since 2004

Germany launched its Renewable Energy Sources Act in 2000. Included in the act was provision for a solar feed-in tariff. It was a simple tariff without size differentiation.

From the year 2000, when total installed solar PV capacity across all of Germany was only 90 MW, capacity grew steadily to 1,000 MW by 2004. However, this growth was insufficient to renewable energy advocates in Germany’s House of Commons, the Bundestag. During the scheduled revisions of the Renewable Energy Sources Act in 2004, tariffs for solar PV were increased and differentiated by size. The revisions also included annual decreases in the tariffs (degression) of from 5 percent to 6.5 percent per year.

Since 2004, Germany has revised its tariffs for solar PV several times. Today, solar PV tariffs in Germany are about one-half those of 2004.

Germany has effectively reached parity for groundmounted solar PV with the residential retail rate, though it has been at grid parity for wind energy for more than a decade.

German costs fell faster than U.S. costs

In contrast to the experience in Germany, Lawrence Berkeley National Laboratory (LBL) found that during the period from 2004 through 2009, the installed cost of solar PV in the U.S. dropped only 10 percent. In “Tracking the Sun III: The Installed Cost of Photovoltaics in the U.S. from 1998-2009” [PDF], LBL also found that the installed cost of residential solar PV in Germany was 61 percent of that in the U.S. That is, Germans were paying 40 percent less to install solar PV on their homes than Americans were.

Based on German experience, it could be argued that California, and the U.S. as a whole, would have proceeded much more quickly toward grid parity for solar PV — and saved taxpayers and ratepayers money — by simply adopting the German feed-in tariffs and letting the industry drive down costs for solar PV on both continents.

What’s next for California?

As the CSI program winds down, the question becomes, “What should California do next?”

During the 2010 campaign, Gov. Jerry Brown said he wants to develop 12,000 MW of distributed generation with feed-in tariffs. If he carries through on his campaign promise, then California’s solar program may morph into just one of many components of a comprehensive feed-in tariff program for multiple technologies.

And if Congress carries through on its threats at belt-tightening, future solar tax credits could be at risk.

California may be wise to create a renewable energy program that’s not only adaptable to future federal action but also more fair to all Californians. The state could, for example, create two feed-in tariff tracks — one for those who can use federal tax credits and another for those who can’t use federal tax credits, or choose not to.

Should Congress eventually axe solar subsidies, California homeowners, farmers, and businesses could then simply use the feed-in tariff track not dependent on federal tax credits.

Adopting German solar PV tariffs in California

California has an international reputation for an overly bureaucratic and cumbersome regulatory process. The state’s Public Utility Commission (PUC) has still not implemented SB32, the California solar industry’s attempt at moving toward a simple feed-in tariff in the state that was signed into law in the fall of 2009.

While interminable hearings on SB32 drag on, the PUC has instead launched another bidding scheme masquerading as a feed-in tariff.

Governor Brown could short-circuit the PUC’s administrative apparatus and simply declare that as part of the state’s new feed-in tariff program for distributed generation, California would simply adopt German tariffs, adjusted for the Golden State’s better solar resource. He could do so on the grounds that the German tariffs are cheaper and more fair to all Californians than the current hodgepodge of programs.