Photo: Gerry BaldingLast week I put up a piece on “what the U.S. power industry thinks about the future of the U.S. power industry,” reposting results from a survey of U.S. power utility managers and executives. Just in case you’re not inclined to read through hundreds of words of survey results and charts (what’s wrong with you?!), I thought I’d pull out a few take-home lessons.

Photo: Gerry BaldingLast week I put up a piece on “what the U.S. power industry thinks about the future of the U.S. power industry,” reposting results from a survey of U.S. power utility managers and executives. Just in case you’re not inclined to read through hundreds of words of survey results and charts (what’s wrong with you?!), I thought I’d pull out a few take-home lessons.

The main lesson — the meta-lesson, if you will — is that the U.S. power sector remains, on average, extremely conservative. I don’t mean ideologically conservative, but small-c conservative: biased in favor of the familiar. It’s not a sector well-suited to producing thought leaders or risk takers. That’s unfortunate, because no area more desperately needs risk-taking and innovation than clean electricity.

One thing to keep in mind is that taking an average across a sample this size can obscure some important differences. There are forward-thinking utilities, most in deregulated (or semi-deregulated) markets, moving purposefully toward a world of renewable power, energy storage, and smart grids. Think Austin Energy, Seattle City Light, or California’s PG&E. But a larger number remain hidebound and congenitally cautious, especially regulated monopolies, like, say, Southern Company. That’s why the results average out on the conservative side.

There’s a social aspect to this conservatism. In some regions of the country (like, say, Southern Company’s), old boys’ networks of utility execs and public utility commissioners go back generations. But it’s also shaped by the financial and regulatory incentives facing utilities. Actors in real markets grapple with competition and the looming threat of being driven out of business. By and large, utilities don’t. They are concerned not with competitors but regulators.

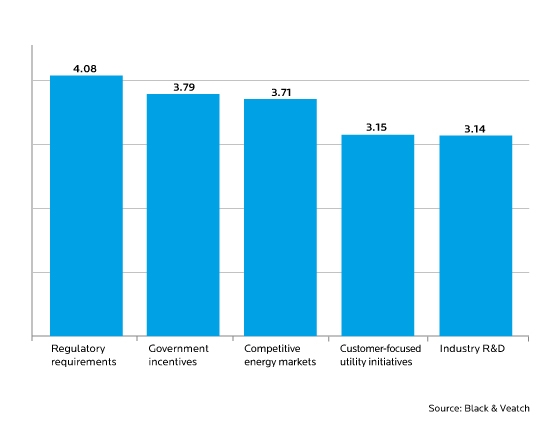

The single most telling chart in the survey shows what utility execs say influences their investment decisions (they ranked the options on a scale of 1 to 5):

For the most part, utility profits are guaranteed as long as utility execs can justify their investment decisions to policymakers and regulators. So they need to appeal to the biases, prejudices, and conventional wisdom of U.S. policymakers and regulators. They need to stay safely within the pack.

As social psychologists know, it is very easy for people to believe what it is in their interests to believe. Thus the small-c conservatism of utility execs. They believe in the inevitability of coal. They believe natural gas is on the ascent and, along with nuclear, will provide most “clean” power in decades to come. Since everything on the menu is a large central power plant, they’re increasingly worried about water management. They are largely bemused by smart-grid talk and don’t hear much about it from customers, though they’re excited about the prospect of new demand from electric cars. Their equipment is aging and in need of replacement, so power prices are going to go up. They are waiting for policymakers and regulators to tell them what to do.

Again, to emphasize, this does not describe all utilities. But it describes the bulk of them. And it raises a question: Are these the best institutions to rely on to achieve the innovation and entrepreneurialism that will be needed to transform U.S. power systems?

By way of an answer, here’s an anecdote. In 2000, Germany passed a law that encouraged widespread installation of clean power, which at that time constituted 5 percent of Germany’s supply. Ten years later, renewables provide 17 percent — an extraordinary rate of growth. How much of that new renewable energy is owned and operated by Germany’s big four utilities? Just 4 percent. The job market is booming and costs are falling, but it’s happening in the world of munis, co-ops, private businesses, and individuals. And the utilities are in trouble.

I’m just saying.