For 50 years, nuclear advocates have been promising that future costs of reactors will come down. A new report this week from MIT calls on Congress to place a very big bet on that proposition. It recommends that the “implementation of the first mover program of incentives should be accelerated” but “the incentive program should not be extended beyond the first movers (first 7-10 plants) since we believe that nuclear energy should be able to compete on the open market as should other energy options. “

The report is only the latest in a series from MIT that grossly underestimates the likely cost of new nuclear reactors and overestimates the ability of the industry to operate on its own without heavy reliance on French-style government subsidies. In reality, the cost of these so-called “first mover” reactors is likely to be in the range of $70 billion to $100 billion. Further, there is little chance that nuclear reactors will ever be able to compete on the open market; they never have.

In a recent analysis, (“Policy Challenges of Nuclear Reactor Construction: Cost Escalation and Crowding Out Alternatives“), I examined the history of nuclear reactor cost projection and cost escalation in the U. S. and France (which is frequently held up as a role model for the U.S. to follow). I included both historical and contemporary patterns.

The bottom line: There is no evidence to support the claim that nuclear reactor costs will come down. Costs have continuously escalated over time. The underlying problems that afflict the industry stem from the nature of the technology. The complexity of nuclear reactors and the site-specific nature of deployment make standardization difficult, so cost reductions have not been achieved and are not likely in the future. Building larger reactors to achieve economies of scale causes construction times to increase, offsetting the cost savings of larger reactors. More recent, more complex technologies are more costly to construct.

The only two French nuclear construction projects to date in Western nations (an export project at Olkiluoto, Finland and a home-country project at Flamanville),both originally projected to take four years to complete, are years behind schedule and billions of dollars over budget.

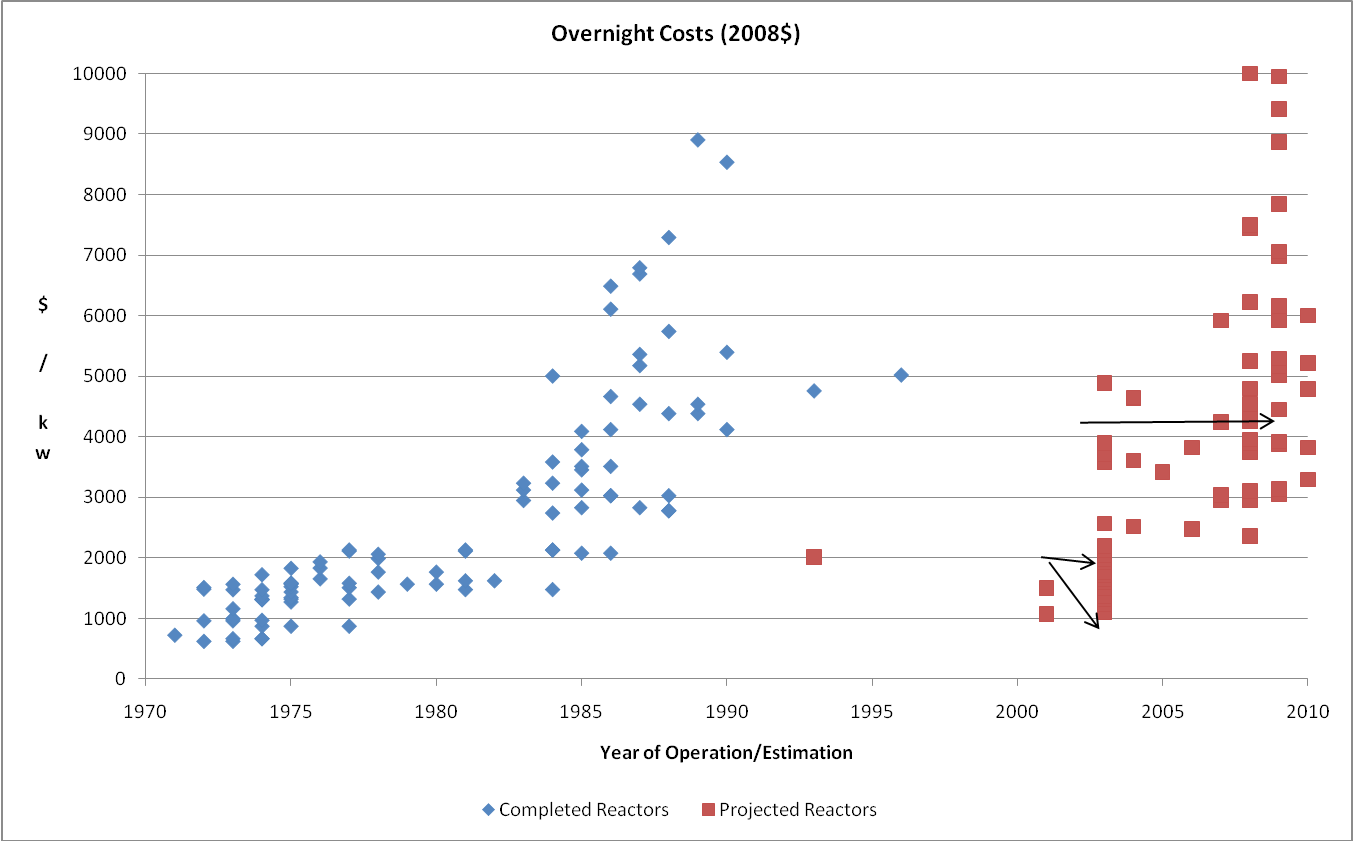

Projections of the cost of construction in the U.S. have tripled over the past decade and MIT has consistently lowballed construction costs (click for larger version):

The 2003 study used costs of $2000/KW as a base case and discussed learning and other processes that would lower those costs to $1,000/KW. In 2009, MIT updated its study and used $4,000/KW as a base case. Today, utilities are using costs in the range of $5,000 to $6,000/KW and independent analysts put them in the $8,000 to $10,000/KW range.

Unfortunately for taxpayers and ratepayers in this nation, the French reactor design that is having so much trouble abroad is one of the next in line for a U.S. loan guarantee and its projected costs are well above the average for U.S. reactors.

The MIT analysis is riddled with flaws typical of nuclear advocates. Because MIT underestimates the cost of nuclear reactors, it assumes that the barrier to nuclear reactor construction is “the perceived financial risk of building new nuclear plants.” In fact, the construction costs really are higher and nuclear reactors face a host of other risks — technology risk, execution risks, and marketplace risks — which are reflected in the financial risk premium. Shifting the risk to taxpayers with loan guarantees does not eliminate those risks; it simply moves them from investors to taxpayers.

The MIT analysis also fails to consider the full range of alternatives for meeting energy needs in a low carbon future. With a low estimate of construction costs, large subsidies, and a “modest price on carbon,” the MIT report concludes that nuclear costs would be lower than natural gas or coal. Two of these three assumptions are wrong, but even more important are the potential resources MIT did not consider.

The most recent study of “Comparative Costs of California Central Station Electricity Generation” (PDF) from the California Energy Commission, which pegged the cost of nuclear at $6,000/KW, identified 11 renewable technologies that are lower in cost than nuclear. Efficiency, which was not considered in the MIT analysis, has been identified as the lowest cost, most plentiful low-carbon resource. The CEO of the nation’s largest nuclear utility — Exelon’s John Rowe — has circulated an analysis that shows new nuclear reactors as far more costly than efficiency, several renewables, and natural gas, an analysis that has led his company to push the pause button on new nuclear reactors.

Another critical omission in the MIT analysis is the fact that large commitments to nuclear construction tends to crowd out alternatives. The financial and managerial resources of the utility are concentrated on bringing these large complex plants online. Policies that reduce demand or promote alternatives are seen as a threat to the viability of the large nuclear project. My analysis of France and the U.S. bears this out.

In France, the commitment to nuclear reactors resulted in excess capacity, which led to policies to promote consumption, like a reliance on baseboard electric resistance heating, and opposition to policies to promote efficiency. As a result, France has a high level of consumption and a low level of reliance on renewable sources of energy compared to other similarly situated European nations.

The evidence is even stronger in the U.S., which consumes 50 percent more electricity per dollar of income per capita than the Western European nations. States where utilities have not expressed an interest in getting licenses for new nuclear reactors have a better track record on efficiency. These states spent three times as much on efficiency in 2006; saved over three times as much energy in the 1992-2006 period; and have much stronger utility efficiency programs in place. These states also had three times as much renewable energy and ten times as much non-hydro renewable energy in their 1990 generation mix and set RPS goals for the next decade that are 50 percent higher.

Analyzing the full range of alternatives and recognizing the dramatic declines in demand growth resulting from the ongoing recession and economic restructuring leads to the conclusion that new nuclear reactors are uneconomic and will not be not necessary for at least several decades to keep the lights on and to meet carbon reduction targets, should they be imposed. As a very expensive source of electricity and a very expensive way to reduce carbon emissions, they are a very big and very bad bet for taxpayers and the economy.

As the pressure on policy makers to do “something” in

energy policy mounts, their attention to facts and data declines, but the reality does not change. MIT’s new report is little more than an uncritical sales pitch for massive taxpayer-backed loan guarantees in the U.S. What we need is a serious-minded and balanced analysis of the cost and benefits of the electricity options the nation actually has.