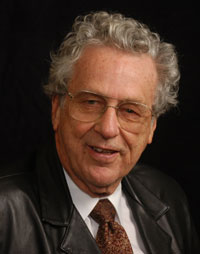

Charles PerrowRegulation, regulation, regulation. Until the U.S. can make the switch to renewables, insists professor and author Charles Perrow, regulation is the best way to prevent disasters like the Gulf oil spill. Perrow is an organizational theorist, emeritus professor at Yale University, and author of Normal Accidents: Living with High Risk Technologies. He studies accidents. Well, actually the social implications of accidents — in nuclear plants, the airline industry, chemical plants, and other risky techno enterprises like drilling for oil at the bottom of the sea. Here’s what he had to say about the latest “accident” in the Gulf.

Charles PerrowRegulation, regulation, regulation. Until the U.S. can make the switch to renewables, insists professor and author Charles Perrow, regulation is the best way to prevent disasters like the Gulf oil spill. Perrow is an organizational theorist, emeritus professor at Yale University, and author of Normal Accidents: Living with High Risk Technologies. He studies accidents. Well, actually the social implications of accidents — in nuclear plants, the airline industry, chemical plants, and other risky techno enterprises like drilling for oil at the bottom of the sea. Here’s what he had to say about the latest “accident” in the Gulf.

Q. When it comes to operating safety, how would you rate the oil industry?

A. There are two aspects to that question. There’s an enormous amount of damage done by small spills — loading, offloading of tankers, etc. — and small accidents that are not sufficiently recorded. In terms of oil rigs, there’s always a danger. It’s a sloppy job. The seas are rough. They’ve got to move fast. There have been big blowouts before. I wouldn’t say they’re rare, but they’re not very frequent, and they could be reduced substantially with tighter safety requirements. Norway and Brazil, for example, require a remote control shut off called an ‘acoustic switch.’ They are expensive, about half a million dollars on a rig of this size.

Q. Oil companies have been known to point out that given all the challenges of the drilling business, we should be thankful there aren’t more spills. Do you agree?

A. That’s a have-you-stopped-beating-your-wife kind of question. The challenge is great. The technology is generally terrific. But we could have many fewer spills. The companies, and especially BP, do not try as hard as they should to prevent them.

BP’s record is fairly alarming. They were responsible for not having the oil removal equipment available during the Exxon Valdez spill. They had actually laid off the trained cleanup crew members and replaced them with untrained crew. The ship that was supposed to take the equipment [skimmers, floating booms, etc.] and crews out to the spill was in dry dock, and no replacement ship was available. [BP] had to fly the booms in from places like Louisiana, because they just didn’t have the stockpile on hand.

Then there’s the Canadian pipeline neglect (March 2006), and the Texas City disaster in March 2005.

Our landscape is punctuated by these kinds of events, because we run higher risks (than Europe for example), and we have insufficient regulatory protection. We’re really still a cowboy economy.

A year or two ago, the European Union passed a wonderful bill that instead of the victims of a wrongdoing having to prove their case in court that the company was not playing safe, the company has to prove that it was playing safe. That’s a very big change. It has scared U.S. companies.

Q. So, is more regulation the answer?

A. Yes. This is capitalism and it has to be heavily regulated where there are chances of large catastrophes. Because otherwise profit concerns will push managers to take risks that we should not be willing to take. Whenever there can be a large catastrophe — 100 or more of what they call ‘prompt’ deaths, 1,000 ‘soon’ deaths, or irretrievable environmental damage — then you need regulations.

Q. Is safety really possible in high-risk endeavors like offshore drilling?

A. It is possible. You can make things quite safe. If you look at the differences between countries that do offshore drilling, Brazil and Norway have very exemplary records, [while] the U.S. and Australia are pretty bad. You always run some risk, but we are always running too many risks.

Q. What about contingency plans? With the Gulf oil spill it seems that beyond the “blowout preventer,” there really weren’t any other contingency plans. Don’t oil companies model worst-case scenarios and make plans for how to handle them?

A. Lee Clarke, [Rutgers University sociology professor and author of Mission Impossible: Using Fantasy Documents to Tame Disaster], calls the contingency plans ‘fantasy documents.’ People want to believe in them, so even people in the firms or the government get kind of spooked into thinking that these fantasy plans can work and that everything will come together correctly. You need redundancies, backups. [BP] should have had that big dome sitting there, because they have a lot of deep drilling rigs in the Gulf, and because this is not the first blow out.

Q. Assuming that offshore drilling will never be 100 percent accident-free, how can we avoid or mitigate the consequences of failure?

A. Raise the liability limit enormously. It will raise the cost of gas, and that might eat into [oil company] profits, but it would give more power to federal regulators. Still, that’s still preventive. You want to know about recovering, about resiliency. If cost is raised, companies will have to invest in resiliency — they’ll have to invest in more booms, etc. But the long-range, ultimate solution is that we stop pumping oil and turn to renewables. We put in a carbon tax and within 10 years we could have solar, wind and geothermal running everything. That’s tricky politically, almost impossible. There’s no push [to act].

Coal and oil are big, politically powerful industries. The [renewable industry] is dispersed. It’s thousands of little industries. We have to empower those thousands.

Q. Can a renewable industry, even an organized, empowered one, really compete against the big coal and big oil lobbies?

A. I’ve looked into carbon capture and storage and this is the main bridge to renewable. The technology is there for stripping out CO2. Norway has been successfully storing [CO2] in the ocean. We can buy out the coal and electric power industries by subsidizing carbon capture and storage. You’ve got to buy them out.