Cross-posted from the Wonk Room.

The effort of Senators John Kerry (D-Mass.), Lindsey Graham (R-S.C.), and Joe Lieberman (I-Conn.) to craft comprehensive clean energy legislation that caps global warming pollution has brought some positive words from Big Oil and their political allies. In particular, the senators are considering a proposal by ConocoPhillips, BP America, and Exxon Mobil to exclude petroleum producers and refiners from a carbon market and instead levy a carbon fee. “Once you have oil people saying, ‘We can live with this, this was our idea,’ then hopefully everybody else begins to look at this thing anew,” Graham told reporters. “That’s the hope.” However, the American Petroleum Institute’s Jack Gerard explained that the “support” from the oil industry for a carbon fee on petroleum will come in the form of “signs at the gas pump letting people know they’re paying more because of U.S. efforts to deal with climate change”:

Industry officials said they too welcome the discussions of a carbon fee as part of the Kerry-Graham-Lieberman effort.

“Clearly it softens the reaction and increases the likelihood that a number of people who’ve been forced to push back will be much more cooperative in the dialogue,” said Jack Gerard, president of the American Petroleum Institute.

Gerard said that the carbon fee approach would yield net environmental benefits, while giving consumers the most transparent signal they can get about what the costs are from the program. Unlike the House bill’s cap-and-trade system, oil companies would pass through the costs with signs at the gas pump letting people know they’re paying more because of U.S. efforts to deal with climate change.

In other words, the oil industry likes the idea of legislators embracing a carbon fee plan — a plan originally proposed by oil companies — because they’ll be able to blame “U.S. efforts to deal with climate change” on high gas prices. And that is what they’re already doing, with full-page ads in Politico and Roll Call that attack Congress for “new energy taxes”:

Congress will likely consider new taxes on America’s oil and natural gas industry. These new energy taxes will produce wide-reaching effects, and ripple through our economy when America — and Americans — can least afford it.

These unprecedented taxes will serve to reduce investment in new energy supplies at a time when most Americans support developing our domestic oil and natural gas resources. That means less energy, thousands of American jobs being lost and further erosion of our energy security.

Our economy is in crisis, and we need to get the nation on the road to economic recovery. This is no time to burden Americans with new energy costs.

The direct target of this ad is the Obama administration’s effort to remove $80 billion in loopholes and subsidies for the oil industry, which allowed them to reap windfall profits while helping destroy the American economy under Bush. Even now, rising oil markets are threatening to cripple the fragile recovery. There’s simply no evidence that these subsidies have helped necessary exploration or protected American jobs — instead they’ve fattened corporate profits at taxpayers’ expense.

If the oil industry is willing to launch false attacks on the removal of tax loopholes as “unprecedented taxes,” it doesn’t take a rocket scientist to figure how they’ll portray a carbon fee.

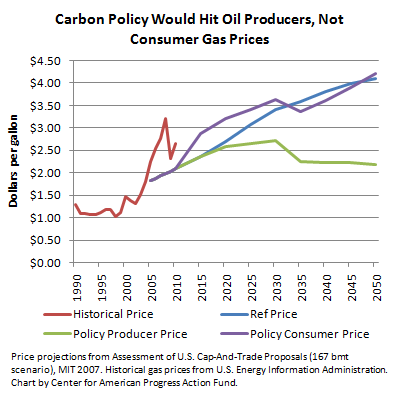

One can bet they won’t mention that even a very strong price on carbon only marginally affects consumer gas prices. Modeling by the Massachusetts Institute of Technology in 2007 of a scenario equivalent to emissions reductions to 1990 levels by 2020 and 80 percent cuts by 2050 found that oil producers would pay most of the pollution fees, not consumers. In fact, after an initial rise in consumer prices in the first decade of implementation that could be offset by increased fuel economy standards, MIT projects consumer gas prices would decline:

The price of gasoline has fluctuated between two and four dollars a gallon in recent years, whereas the effect of carbon policy is only cents on the gallon. Yet every cent is one that stays in the American economy going to create jobs and maintain our infrastructure, instead of flowing overseas to countries like Iran and Nigeria. Quite simply, putting a price on carbon is a fundamental threat to the power of the oil industry over the U.S. economy.