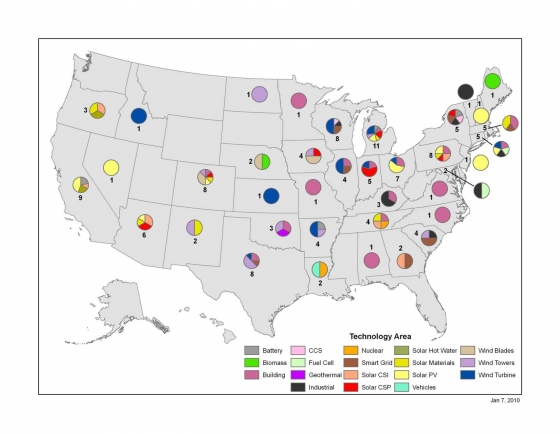

Today the Obama administration unveiled $2.3 billion in new tax credits to clean energy manufacturing companies. There were 183 projects selected out of some 500 applications; one-third were from small businesses; around 30% are expected to be completed this year. The winners are spread across 43 states. Here’s a map from White House adviser Carol Browner’s post:

Couple of things to say about this.

First: this is industrial policy, but it’s better than average industrial policy. As Duncan Black says:

One of my longstanding pet peeves is that everyone in the US pretends we don’t have an “industrial policy” because that implies naughty state intervention in certain sectors. But of course we have lots of naughty state intervention in certain sectors, we just don’t do it even notionally for any good reason. We prop up the single family homebuilding industry and the automobile industry (even before the bailouts). We prop up certain agricultural sectors. We favor big business over small. Now we’re massively propping up one skimmer industry – the financial industry – and are about to prop up another skimmer industry – health insurance.

So, yes, by design or accident we have industry policy. We should recognize that and then decide what we should be doing instead of pretending we don’t have any.

Right. What should we do instead? Nurture small businesses in markets that are almost universally forecast to undergo rapid growth for decades to come; put struggling American workers and idled American manufacturing capacity back to work; reduce greenhouse gas emissions.

Still, this kind of policy has its limitations. Though “senior administration officials” (what a goofy convention that is, by the way) say every application went through five levels of review, inevitably there are going to be political considerations in how the money is distributed — it’s probably no accident the credits are spread so widely, geographically and across industries. (Though this detracts from the economic efficiency, in may improve the politics — see below.)

It’s also absurd that clean energy industries still depend on capricious, short-term extensions of tax credits. Tax-based policy has become more and more common lately, mainly because the legislative branch has become so dysfunctional (budgets are passed by a majority instead of the 60 votes required of legislation), but it’s a bad thing. A carbon price, direct public investment, performance standards, renewable energy standards, feed-in tariffs — anything structural and persistent is better than these come-and-go dispensations of cash. Obama has called on Congress to cough up $5 billion a year for these credits, but how enduring will yearly appropriations be the next time Congress changes hands?

Second, despite reservations about the policy, this is the kind of thing Obama needs to do to build real, on-the-ground support for clean energy. Have a look at this fantastic new video from News21:

The people in this Texas town — and their families, and friends, and visitors — will never again think of clean energy as something by and for dirty hippies. The more such people there are, the more politics become friendly to ambitious legislation. In fact I’d argue that deploying clean energy and efficiency will matter far more to the politics of this issue than anything done by NGOs. No amount of “framing” competes with having a wind turbine save your farm.